Create articles from any YouTube video or use our API to get YouTube transcriptions

Start for freeUnderstanding Company Valuation

Valuing a company is a critical skill for investors and corporate acquirers. It determines whether you are getting value for your money or potentially overpaying for an investment. The process, which can seem daunting due to its complexity, involves several methodologies that provide different perspectives on a company's worth.

The Art of Valuation

Valuing a company is more art than science. It involves interpreting numbers but also understanding market conditions and investor expectations. A company, much like real estate, holds value that is ultimately determined by what someone is willing to pay. This subjective nature makes it essential to approach valuation from multiple angles to establish a well-rounded view of a company's worth.

Three Core Valuation Methods

1. Asset-Based Approach

The first method is the Asset-Based Approach. This technique starts with the company's balance sheet, which lists all assets and liabilities. Investors adjust these figures based on their perceptions of asset reliability and market conditions, arriving at an asset-based valuation figure. This method often sets the groundwork for understanding the tangible worth of a company but does not typically account for future earning potentials.

2. Ratio-Based Approach

Next is the Ratio-Based Approach, which compares the target company to similar companies within the same industry. Key metrics such as Price-to-Earnings (PE) Ratio or Price-to-Sales Ratio are used here. By analyzing these ratios, investors can gauge how similarly positioned companies are valued in the market, providing a comparative benchmark.

For instance, if similar companies have a PE ratio around 10, an investor might multiply the target company's earnings by this figure to estimate its market value. This method helps in understanding how the market values companies in the same sector but may not fully account for unique aspects of the target company’s operations or market position.

3. Discounted Cash Flow (DCF)

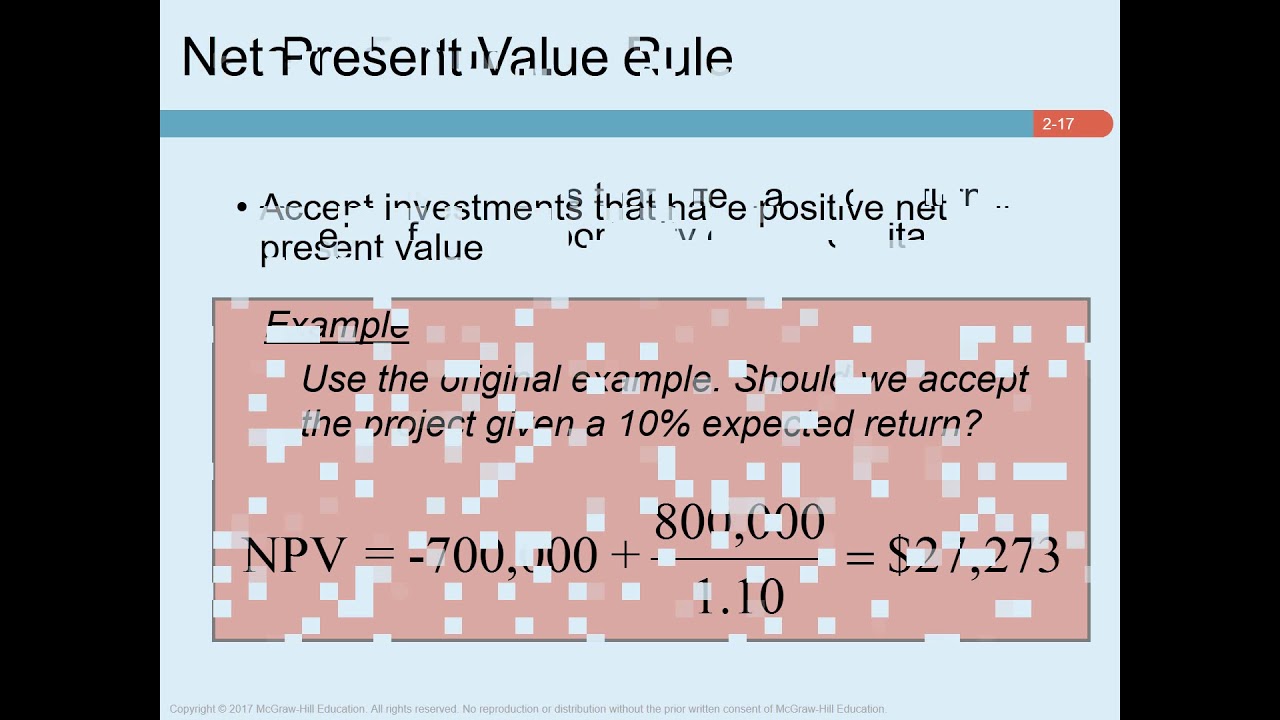

The most comprehensive approach is Discounted Cash Flow (DCF), which involves forecasting the future cash flows of a company and discounting them back to their present value using an appropriate discount rate. This method considers both current performance and future potential, making it particularly useful for evaluating companies with significant growth prospects or those operating in volatile industries.

Practical Application in Negotiations

Armed with these three valuations—asset-based, ratio-based, and discounted cash flow—an investor or acquirer can enter negotiations with a robust understanding of what constitutes a fair price range for a target company.

Each method might yield different figures; hence it’s common practice to use more than one approach to triangulate on an appropriate valuation range before making an offer.

Conclusion

In conclusion, mastering these three valuation techniques equips investors with necessary tools to make informed decisions about buying shares or acquiring entire companies.

Article created from: https://www.youtube.com/watch?v=YG51nUZBsHU&list=PLBj-sddFhkAAxAGX_ncQM_j7BIQeIXvBF&index=14