Create articles from any YouTube video or use our API to get YouTube transcriptions

Start for freeUnderstanding Capital Budgeting Methods

Capital budgeting is an essential process for businesses to evaluate potential investments and projects. This practice is divided into two main categories: discounted cash flow (DCF) techniques and non-discounted cash flow techniques. The former includes methods that take into account the present value of future cash flows, while the latter does not consider the time value of money.

Non-Discounted Cash Flow Techniques

Non-discounted cash flow methods are less popular among finance managers due to their lack of sensitivity to time value. These methods include the Book Rate of Return and the Payback Period.

Book Rate of Return

The Book Rate of Return is calculated by looking at the prospective book income as a percentage of the book value of assets a firm proposes to acquire. It's a measure of profitability based on accounting income and assets as reported in financial statements.

- Calculation: Book Income / Book Assets

- Decision Rule: If the Book Rate of Return is greater than a project's cost of capital, the project is accepted; otherwise, it's rejected.

However, because the book rate of return hinges on accounting methods and the capitalization and expensing decisions made by accountants, it can be heavily influenced by managerial choices. This makes it one of the least favored techniques for capital budgeting.

Payback Period

The Payback Period method measures how quickly an investment can recoup its initial cost. It's favored for its simplicity but criticized for ignoring the time value of money and cash flows occurring after the payback period.

-

Advantage: Simplicity and ease of understanding.

-

Limitations:

- Does not account for the time value of money.

- Ignores cash flows after the payback period.

Discounted Cash Flow Techniques

Discounted cash flow techniques, on the other hand, are more commonly used due to their consideration of the time value of money. Two popular DCF methods are the Net Present Value (NPV) and the Internal Rate of Return (IRR).

Net Present Value (NPV)

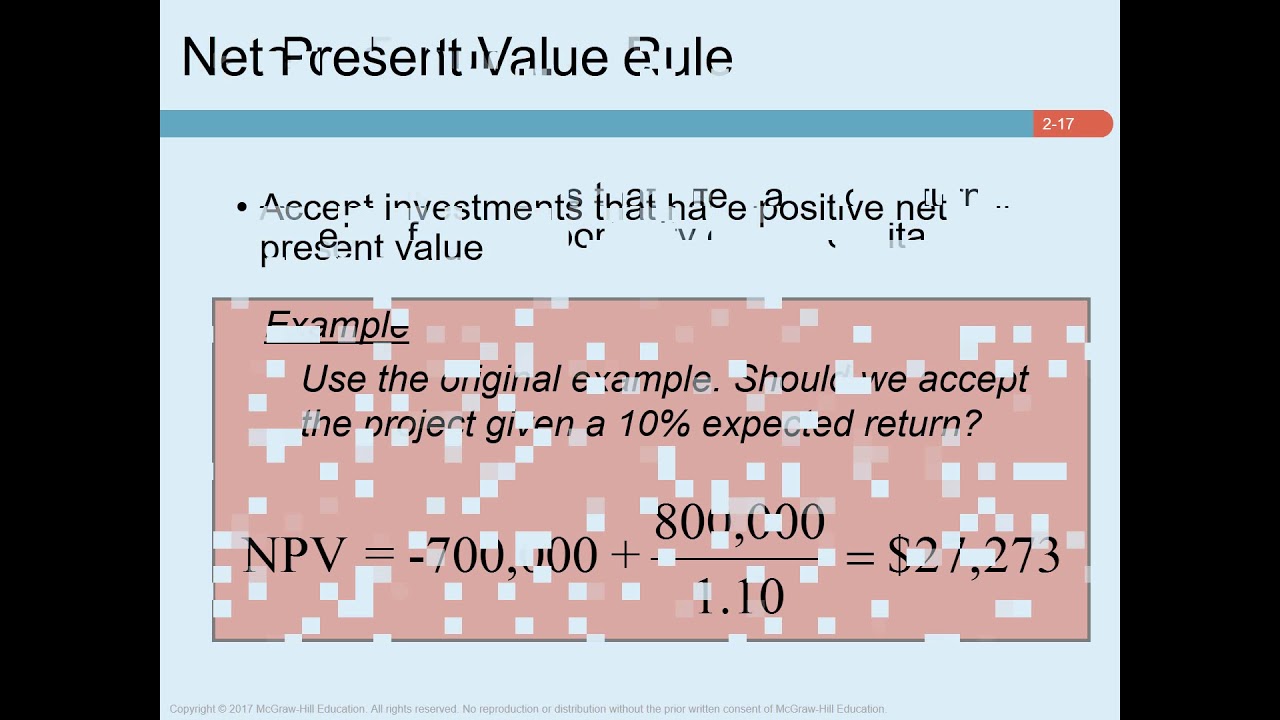

NPV involves discounting future cash flows back to their present value and comparing this to the initial investment. A positive NPV indicates that the project is expected to generate more value than its cost, making it an attractive option.

- Decision Rule: Accept projects with a positive NPV.

The NPV method is favored because it accounts for the opportunity cost of capital and provides a clear measure of the added value from a project.

Internal Rate of Return (IRR)

While IRR will be discussed in more detail in the next lecture, it's worth noting that it is the discount rate that makes the NPV of all cash flows from a particular project equal to zero.

- Decision Rule: Accept projects with an IRR greater than the cost of capital.

The IRR method is appreciated for its ability to provide a single percentage that reflects the profitability of a project.

Conclusion

In summary, while non-discounted cash flow techniques offer simplicity, they lack the depth of analysis provided by discounted cash flow methods. Finance managers often prefer DCF techniques due to their consideration of the time value of money and a more comprehensive understanding of a project's potential profitability.

In our next video, we will delve into IRR and its pros and cons, providing a more complete picture of discounted cash flow analysis in capital budgeting. Stay tuned for more insightful discussions on financial management strategies.

Watch the full lecture on capital budgeting methods on YouTube here.