Create articles from any YouTube video or use our API to get YouTube transcriptions

Start for freeThe Power of the $10,000 Milestone

When it comes to personal finance, there's a magic number that can completely change your financial outlook: $10,000. This figure might seem arbitrary at first glance, but it represents a crucial turning point in your financial journey. Let's delve into why reaching this milestone is so significant and how it can set you on the path to greater financial success.

Why $10,000 Matters

The journey to $10,000 in savings is more than just accumulating a specific amount of money. It's about developing habits, changing your mindset, and laying the groundwork for future financial growth. Here's why this number is so important:

-

It's a Mental Breakthrough: Seeing five figures in your bank account for the first time can be a powerful psychological boost. It's the moment when financial success starts to feel tangible and achievable.

-

Emergency Fund Security: $10,000 provides a solid cushion for unexpected expenses, reducing financial stress and allowing you to focus on long-term goals.

-

Habit Formation: The discipline required to save $10,000 creates positive financial habits that will serve you well as you aim for higher goals.

-

Shift in Perspective: With $10,000 saved, you can start thinking strategically about your finances rather than just focusing on day-to-day survival.

-

Compound Interest Becomes Meaningful: At this level, the returns on your investments start to become noticeable, motivating further saving and investing.

-

Financial Myth Busting: Reaching this milestone often requires dispelling common financial misconceptions and focusing on what truly matters.

-

Income Growth Focus: With basic savings secured, you can shift your attention to increasing your income, which is crucial for building wealth.

Now, let's explore each of these points in more detail and understand how they contribute to your financial transformation.

1. The First Mental Breakthrough

Reaching $10,000 in savings is often the first time many people experience a true sense of financial accomplishment. It's a psychological milestone that can dramatically change how you view money and your ability to manage it.

From Theory to Reality

You might have read countless personal finance books or articles, but seeing $10,000 in your account makes financial success feel real. It's the difference between knowing something intellectually and experiencing it firsthand. This tangible proof of your financial capabilities can be incredibly empowering.

Boosting Financial Confidence

When you cross the $10,000 threshold, your brain registers a significant achievement. You start to believe, "I can actually do this." This newfound confidence isn't just about feeling good; it changes how you approach financial decisions.

Changing Financial Behavior

With increased confidence comes a shift in behavior:

- You're less likely to panic over small expenses.

- You become more discerning about financial advice and less susceptible to get-rich-quick schemes.

- You start to feel more in control of your financial destiny.

This mental breakthrough is about more than just money in the bank; it's your first real dose of financial self-assurance.

2. The Tipping Point for Emergency Peace of Mind

One of the most significant benefits of reaching $10,000 in savings is the financial security it provides. While it may not cover a full year of expenses, it offers substantial breathing room in case of emergencies.

The Reality of Unexpected Expenses

Life is unpredictable, and unexpected costs can arise at any time:

- Car repairs

- Medical expenses

- Home maintenance issues

- Job loss

Without adequate savings, these situations can quickly lead to financial stress or debt.

The $10,000 Buffer

With $10,000 in savings, you have a substantial buffer against many common financial emergencies. This means:

- You can handle surprise expenses without resorting to high-interest credit cards or loans.

- You don't have to dip into long-term investments or retirement accounts.

- You can make decisions based on what's best for you, not out of financial desperation.

Mental Bandwidth and Focus

The peace of mind that comes with having an emergency fund frees up mental energy. Instead of constantly worrying about potential financial disasters, you can focus on:

- Career growth and negotiating better salaries

- Starting side businesses or passion projects

- Consistent investing for long-term wealth building

This shift from a scarcity mindset to one of opportunity and growth is invaluable for your financial journey.

3. The Power of Habit Formation

Reaching $10,000 in savings is rarely an accident. It's the result of intentional habits and disciplined financial behavior. These habits are the true treasure, as they will continue to serve you well beyond this initial milestone.

Building a Savings System

To accumulate $10,000, you likely developed a system that works for you. This might include:

- Setting up automatic transfers to your savings account

- Creating and sticking to a conscious spending plan

- Regularly reviewing and adjusting your financial strategies

These habits form the foundation of good financial management.

The Importance of Saying 'No'

Reaching this milestone often requires making tough choices and prioritizing your financial goals over immediate gratification. You've learned the valuable skill of delayed gratification, which is crucial for long-term financial success.

Scaling Your Success

The great news is that the same habits that got you to $10,000 can take you much further. To reach $100,000 or beyond, you don't need to reinvent the wheel. Instead, you can:

- Increase the intensity of your savings habits

- Apply your disciplined approach to larger financial goals

- Maintain patience and consistency in your financial journey

Consistency Over Perfection

Remember, it's not about being perfect every day. The power lies in consistently applying good financial habits over time. Small, regular actions compound to create significant results.

4. Shifting from Survival to Strategy

One of the most transformative aspects of reaching $10,000 in savings is the shift in your financial mindset. You move from a day-to-day survival mode to a more strategic, long-term approach to your finances.

Before the $10,000 Milestone

Prior to reaching this level of savings, many people experience:

- Constant financial stress

- Budgeting down to the last penny

- Guilt over small purchases like coffee or meals out

- A focus on immediate financial needs rather than long-term goals

This survival mindset can be exhausting and limiting, preventing you from seeing the bigger financial picture.

The Strategic Shift

Once you pass the $10,000 mark, you gain the ability to zoom out and look at your finances more holistically. You start asking different questions:

- How can I grow my income?

- What are the best investment strategies for my goals?

- What does my ideal financial future look like?

From Penny-Pinching to Value-Based Spending

With a solid savings foundation, you can start making more intentional decisions about your money. This might mean:

- Spending more on things that truly matter to you

- Investing in experiences or items that align with your values

- Being more generous with tipping or charitable giving

Strategic Money Management

You can now use your money as a tool to improve your life and work towards your goals. This might include:

- Investing in personal development or education

- Starting a side business or passion project

- Allocating funds for long-term wealth building through investments

Protecting Your Financial Future

Part of strategic money management is also protecting what you've built. This includes considering things like:

- Adequate insurance coverage

- Estate planning

- Protecting your personal information online

For example, services like DeleteMe can help protect your personal information from being sold online by data brokers, adding an extra layer of security to your financial life.

5. The Power of Compound Interest

As your savings grow to $10,000 and beyond, you start to experience the real power of compound interest. This is when your money begins to work for you, generating returns that can significantly accelerate your wealth-building journey.

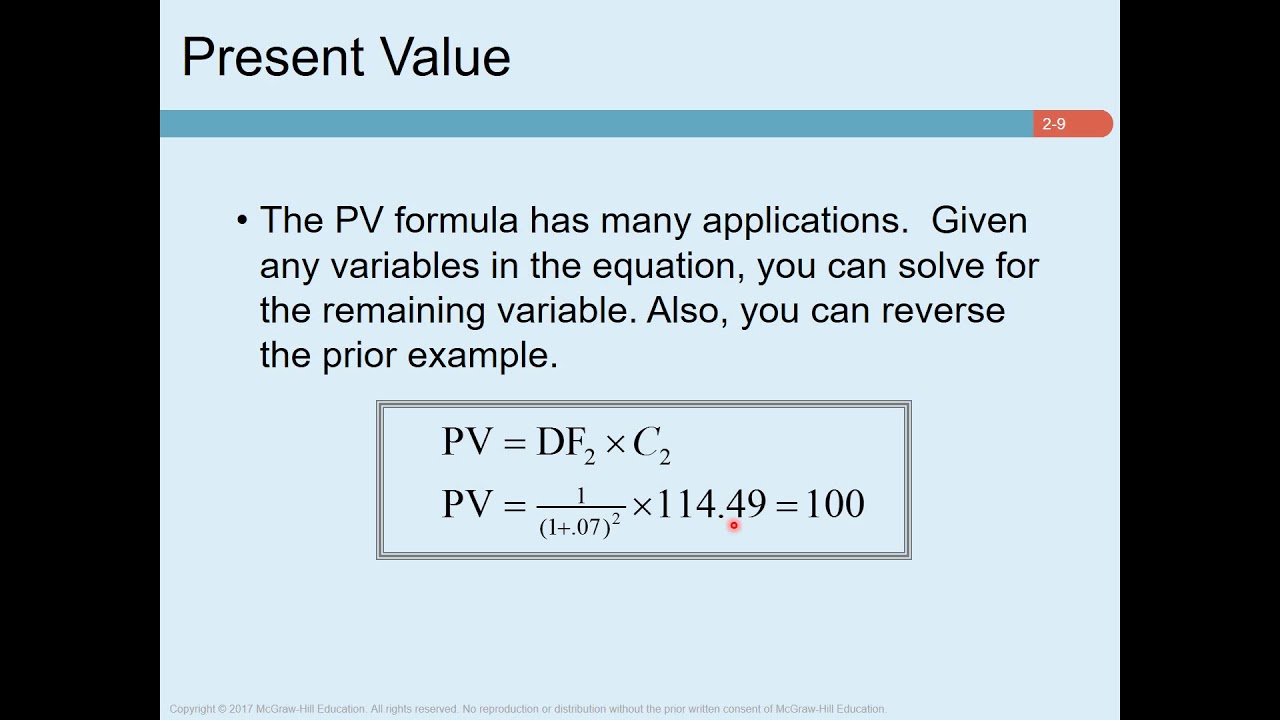

Understanding Compound Interest

Compound interest is the process where the interest you earn on your savings or investments starts to generate its own interest. Over time, this can lead to exponential growth of your wealth.

The Tangible Impact

Let's look at a simple example:

- If you invest $500 and earn a 7% annual return, you'll make $35 in a year.

- But if you invest $10,000 at the same rate, you'll earn $700 in a year.

Suddenly, your money is generating a meaningful amount of additional income just by being invested.

The Snowball Effect

Compound interest works like a snowball rolling down a hill:

- At first, the gains might seem small and insignificant.

- But as your investment grows, the returns become larger and more impactful.

- Over time, the growth can become exponential.

Long-Term Perspective

The real power of compound interest is revealed over longer periods:

- After 10 years, your $10,000 invested at 7% could grow to over $19,000.

- After 20 years, it could be worth over $38,000.

- After 30 years, it might exceed $76,000.

All of this growth occurs without you having to add any additional money to the initial investment.

Motivation for Consistent Investing

Seeing the tangible results of compound interest can be a powerful motivator to:

- Start investing earlier

- Invest more consistently

- Stay invested for the long term

Beyond Savings Accounts

While savings accounts offer security, to truly harness the power of compound interest, consider:

- Index funds or ETFs

- Retirement accounts like 401(k)s or IRAs

- Dividend-paying stocks

These options typically offer higher potential returns, allowing your money to grow more quickly over time.

6. Dispelling Financial Myths

Reaching $10,000 in savings often requires challenging and overcoming common financial myths. This process of myth-busting is crucial for developing a more sophisticated and effective approach to personal finance.

The Coffee Myth

One of the most pervasive financial myths is that cutting out small daily expenses, like your morning coffee, is the key to building wealth. By the time you've saved $10,000, you've likely realized:

- Skipping your $4 coffee isn't going to make you rich.

- Focus on bigger financial levers is more important.

The Budget Obsession Myth

Many people believe that meticulous budgeting is the path to financial success. However, as you've built your savings, you've probably learned:

- Obsessing over every penny is often counterproductive.

- A broader financial strategy is more effective than micromanaging expenses.

The 'One Size Fits All' Myth

Financial advice often comes in a one-size-fits-all package. But in saving $10,000, you've likely discovered:

- Personal finance is indeed personal.

- What works for others may not work for you.

- Tailoring financial strategies to your specific situation is crucial.

The Quick Rich Scheme Myth

The journey to $10,000 teaches you:

- Get-rich-quick schemes are usually too good to be true.

- Consistent, strategic actions over time are the real path to wealth.

The 'More Information' Myth

Many believe that consuming more financial information leads to better outcomes. However, you've likely realized:

- Action is more important than endless research.

- Implementing a few key principles consistently is more valuable than knowing everything.

The 'Money is Everything' Myth

As you've built your savings, you may have come to understand:

- Money is a tool, not an end in itself.

- Financial decisions should align with your values and life goals.

The 'Perfect Time' Myth

Many people wait for the 'perfect time' to start saving or investing. Reaching $10,000 shows you:

- There's no perfect time; the best time to start is now.

- Consistent action trumps perfect timing.

Developing Financial Wisdom

By dispelling these myths, you've developed a more nuanced understanding of personal finance. This wisdom will serve you well as you continue to grow your wealth beyond the $10,000 milestone.

7. Focusing on Income Growth

One of the most important realizations that often comes with reaching $10,000 in savings is understanding the critical role of income growth in building wealth. While saving and budgeting are important, increasing your income can accelerate your financial progress dramatically.

The Limits of Frugality

As you've built your savings, you've likely realized:

- There's a limit to how much you can cut expenses.

- Extreme frugality can lead to burnout and isn't sustainable long-term.

- You can't budget your way to significant wealth.

The Power of Income Growth

Increasing your income offers several advantages:

- It provides more resources to save and invest.

- It allows you to improve your quality of life while still saving.

- It can accelerate your progress towards larger financial goals.

Strategies for Income Growth

With the foundation of $10,000 in savings, you're in a position to focus on increasing your income. This might include:

-

Negotiating a Raise: Use your track record of success to advocate for higher compensation in your current role.

-

Skill Development: Invest in learning new skills that can make you more valuable in your field.

-

Job Hopping: Sometimes, changing employers can lead to significant salary increases.

-

Starting a Side Business: Use your skills to create additional income streams outside of your main job.

-

Freelancing or Consulting: Leverage your expertise to take on additional paid work.

-

Career Change: Consider pivoting to a higher-paying industry or role.

Taking Calculated Risks

With $10,000 in savings as a safety net, you're in a better position to take calculated career risks that could lead to higher income:

- Pursuing additional education or certifications

- Starting your own business

- Taking on a challenging new role that offers growth potential

The Snowball Effect of Income Growth

As your income increases:

- You can save and invest more without feeling deprived.

- Your investments can grow faster, accelerating wealth accumulation.

- You can more quickly reach larger financial milestones.

Balancing Income Growth and Financial Management

Remember, increasing your income is most effective when combined with smart financial management:

- Avoid lifestyle inflation as your income grows.

- Continue to save and invest a portion of your increased earnings.

- Use your higher income to build multiple streams of revenue.

The Long-Term Impact

Focusing on income growth can have a profound impact on your financial future:

- It can shorten the time needed to reach larger financial goals.

- It provides more options and flexibility in your career and life choices.

- It can lead to greater financial security and peace of mind.

Conclusion: The Journey Beyond $10,000

Reaching $10,000 in savings is a significant milestone, but it's just the beginning of your financial journey. This achievement lays the foundation for even greater financial success and opens up new possibilities for wealth building.

Recap of Key Benefits

Let's revisit the main advantages of reaching this milestone:

- Mental breakthrough and increased financial confidence

- Emergency fund security and peace of mind

- Establishment of powerful financial habits

- Shift from survival mode to strategic financial thinking

- Meaningful impact of compound interest

- Dispelling of common financial myths

- Focus on income growth as a wealth-building strategy

Looking Ahead

As you move beyond $10,000, keep these principles in mind:

- Consistency is Key: Continue applying the habits that got you to $10,000.

- Think Bigger: Set your sights on larger financial goals, like $100,000 or beyond.

- Stay Educated: Keep learning about personal finance, but focus on implementing key strategies.

- Balance: Strive for a balance between saving, investing, and enjoying your money.

- Flexibility: Be prepared to adjust your strategies as your financial situation evolves.

Final Thoughts

Remember, reaching $10,000 in savings is not the end goal; it's a stepping stone to greater financial achievements. Use this milestone as motivation to continue growing your wealth, expanding your financial knowledge, and working towards your long-term financial goals.

Whether your next target is $50,000, $100,000, or beyond, the principles you've learned and applied in reaching $10,000 will serve as a solid foundation. Keep building on this success, stay focused on your goals, and remember that every financial decision you make is a step towards your ideal financial future.

Your journey to financial success is unique and personal. Celebrate your achievements, learn from your experiences, and keep pushing forward. With the right mindset, strategies, and consistent effort, you're well on your way to achieving your financial dreams.

Article created from: https://www.youtube.com/watch?v=3owFOqTAko0