Create articles from any YouTube video or use our API to get YouTube transcriptions

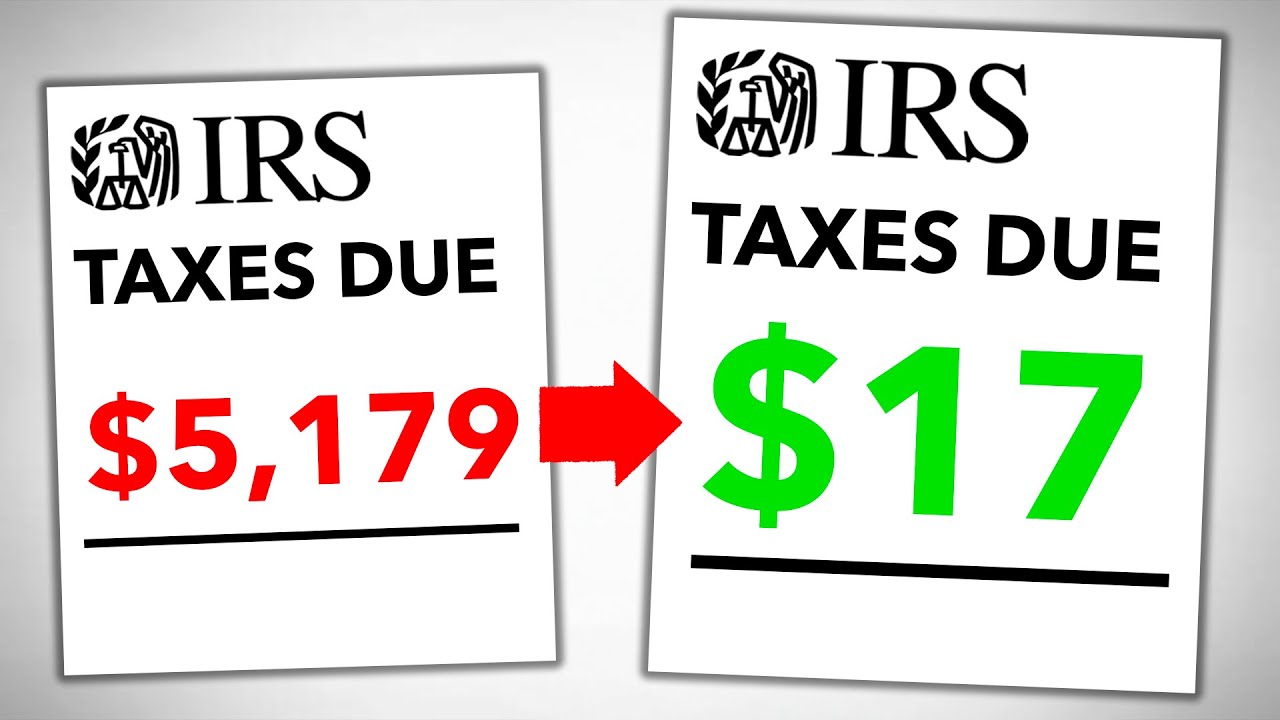

Start for freeUnderstanding the Tax System: A Beginner's Guide

Taxation can often seem overwhelming, with many fearing an increased income could mean a higher tax rate on their entire earnings. However, this misconception stems from a lack of understanding of how progressive tax systems and marginal tax brackets work. In essence, as your income increases, only the amount that falls into higher tax brackets is taxed at a higher rate, not your entire income. This means getting a pay raise is almost always beneficial, contrary to what some might believe.

For example, if your taxable income in 2023 is $60,000 and you're filing as single, you won't be paying a flat 22% on all of it. Instead, your income fills up tax 'buckets' or brackets sequentially, with each bucket having its own tax rate. Such a system ensures only a portion of your income is taxed at the higher rate, making it a more equitable way of taxation.

How to Lower Your Taxable Income

Lowering your taxable income legally is easier than you might think, and it revolves around making strategic moves with your money before it's taxed. Here are some methods:

-

Maximize Qualified Retirement Plans: Contributions to plans like a 401(k) can significantly reduce your taxable income. In 2024, you can contribute up to $23,000 to a 401(k), potentially lowering your taxable income by a considerable margin. Moreover, some employers offer matching contributions, further enhancing your savings and investment potential.

-

Explore Tax-Advantaged Accounts: Other accounts, such as Health Savings Accounts (HSAs) and Traditional IRAs, offer opportunities to reduce taxable income through contributions, each with its own limits and benefits.

-

Change Your Tax Process: If you have a side hustle or own a business, you gain more control over your taxable income. Expenses related to your business can significantly lower your taxable income, from home office deductions to educational expenses.

Strategies for Tax Savings

-

Invest in Retirement Accounts: Beyond standard 401(k)s, consider Solo 401(k)s if you're self-employed. These allow for substantial contributions, further reducing your taxable income.

-

Utilize Business Deductions: Everything from a portion of your living space used for business to electricity, meals, and equipment can be deducted, lowering your taxable income.

-

Capitalize on Long-Term Capital Gains: Investing in assets like real estate or stocks and holding them for more than a year can qualify you for lower tax rates on profits, thanks to long-term capital gains tax rates.

-

Leverage Debt Strategically: Wealthy individuals often use debt to their advantage, borrowing against assets like stock portfolios at low interest rates. This approach allows for income access without direct taxation, as the borrowed amount is not considered taxable income.

Conclusion

Understanding and navigating the tax system is crucial for financial health and growth. By employing strategic approaches to your income and investments, you can significantly reduce your taxable income and tax liability. From taking full advantage of retirement accounts to understanding the benefits of long-term investments and strategic debt, these methods are accessible to most people and can lead to substantial tax savings.

For more detailed strategies and insights into reducing your tax bill, consider consulting with a tax professional who can provide personalized advice based on your financial situation. Remember, the goal is to make strategic moves that align with the tax code, maximizing your income and minimizing your taxes legally.

For further information and examples, reference the original video here.