Create articles from any YouTube video or use our API to get YouTube transcriptions

Start for freeNavigating the complex terrain of retirement savings is a daunting task for many Americans. With a plethora of advice and benchmarks floating around, it's challenging to discern whether you're on track for a financially secure retirement. The goal is to maintain your current living standards, but is this feasible within the American system? Let's dive into the reality of retirement savings and uncover strategies to stay on track, regardless of where you currently stand financially.

Understanding Retirement Savings Benchmarks

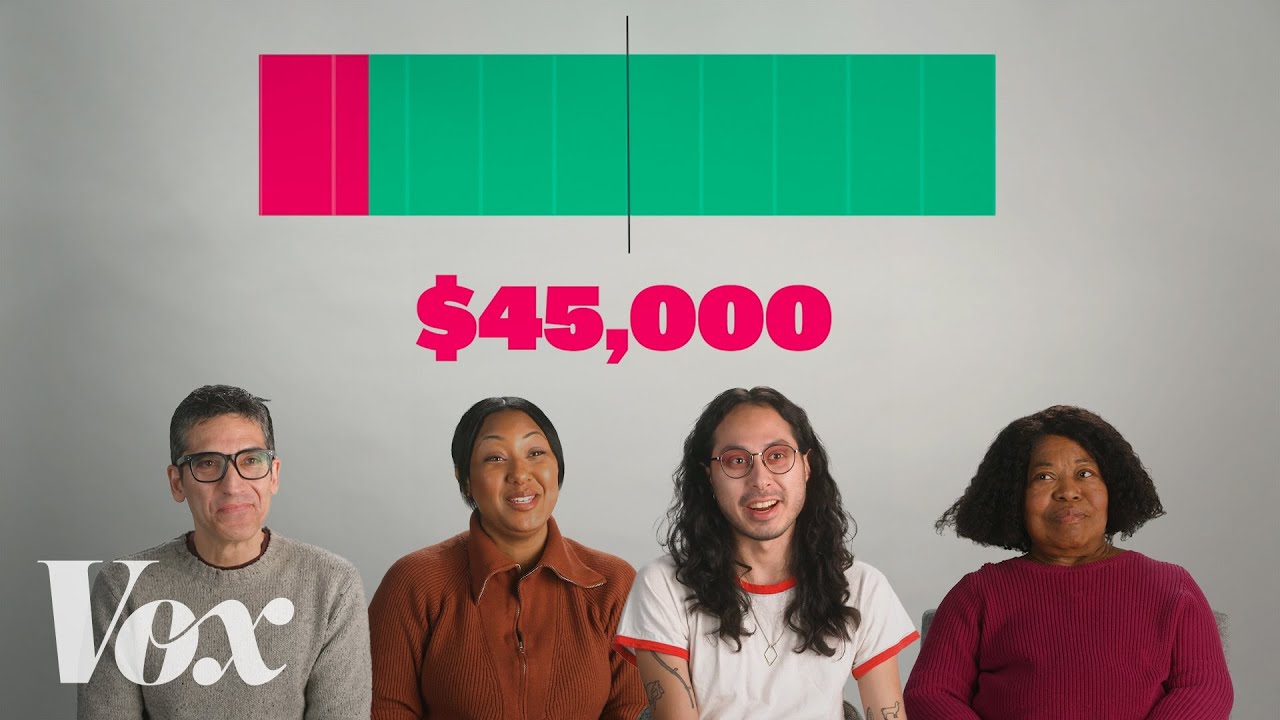

Experts suggest specific benchmarks to gauge if you're on track with your retirement savings. By the time you hit 30, having about one times your current salary saved is advisable. This benchmark rises to 2.5 to 3 times your salary by age 40, and by your 60s, aiming for 8 to 10 times your annual salary is recommended. These numbers might seem lofty, especially when considering the median savings of Americans is approximately $45,000, indicating a significant gap between ideal benchmarks and reality.

The Shift in Pension Systems

The landscape of retirement savings has dramatically shifted over the past decades. Traditional pensions, where employers contribute to a retirement fund that grows over time and provides a lifetime benefit, have become less common. The introduction of 401(k) plans and Individual Retirement Accounts (IRAs) in the late 1970s marked a significant change, moving toward individualized retirement savings accounts. However, this shift also presented challenges, including decreased worker power and the necessity for individuals to make complex investment decisions without professional guidance.

The Challenge of Individualized Accounts

401(k) plans and IRAs put the onus on individuals to save and invest for their retirement. While this model offers flexibility, it also requires a level of financial literacy that many Americans lack. Deciding how much to save, making regular contributions, and choosing the right investments are daunting tasks for those without a financial background. Moreover, the temptation to withdraw from these accounts for immediate needs further complicates the goal of saving for retirement.

The Importance of Consistent Contributions

Despite the intimidating benchmarks and the complex landscape of retirement savings, the key to success lies in consistent contributions. Starting early, even with small amounts, and gradually increasing your savings rate can make a significant difference over time. Employer matches, when available, are a valuable resource that should not be overlooked. It's also crucial to protect your savings from short-term temptations, ensuring that your future self benefits from the sacrifices made today.

Strategies for Staying on Track

-

Start Early and Save Regularly: Begin saving as soon as possible, even if it's a small amount. Regular contributions can compound over time, leading to significant growth in your retirement savings.

-

Take Advantage of Employer Matches: If your employer offers a matching contribution to your retirement plan, make sure to contribute at least enough to receive the full match. It's essentially free money for your retirement.

-

Educate Yourself: While the world of investments can be overwhelming, taking the time to learn about your options can empower you to make informed decisions. Many employers and financial institutions offer resources to help you understand your retirement savings options.

-

Seek Professional Guidance: Consulting with a financial advisor can provide personalized advice tailored to your financial situation and goals. They can help you navigate investment choices and develop a strategy that maximizes your retirement savings.

-

Prioritize Long-Term Savings: Resist the urge to dip into your retirement savings for short-term needs. Protecting these funds ensures they will be available when you need them most – during retirement.

In conclusion, while the benchmarks for retirement savings may seem out of reach for many, the key to securing a financially stable retirement lies in consistent, informed action. By understanding the challenges and employing strategies to overcome them, you can navigate the path to retirement savings success. Remember, it's never too late to start saving for your future.

For more insights, watch the original video here.