Create articles from any YouTube video or use our API to get YouTube transcriptions

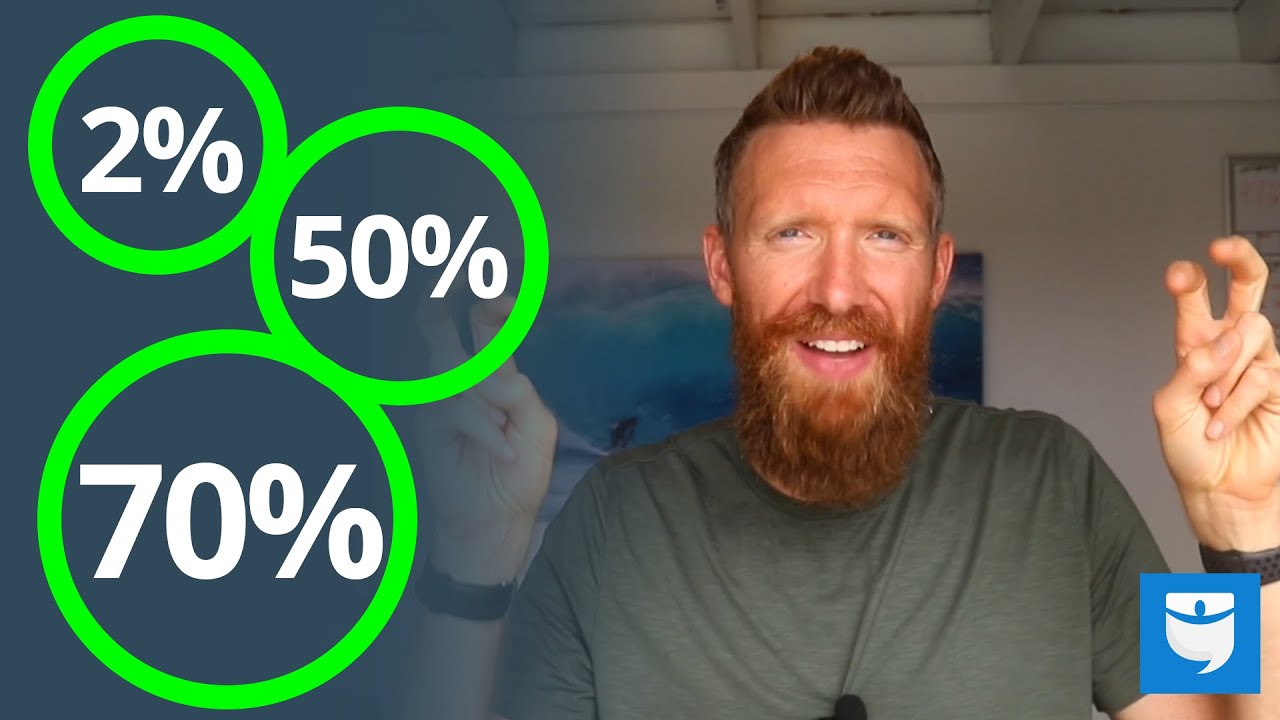

Start for freeReal estate investing can often seem like navigating through a maze, with countless decisions to make and factors to consider. However, certain shortcuts, known as 'rules of thumb,' can help investors quickly screen deals and make educated guesses on which properties to explore further. In this article, we delve into three of the most commonly used rules: the 2% rule, the 50% rule, and the 70% rule, as explained by Brenton Turner. It's crucial to remember that these are not hard and fast laws but rather guidelines to aid in the initial analysis of potential investments. Always conduct a thorough analysis before making any investment decisions. Let's break down these rules to understand how they can benefit your investment strategy.

The 2% Rule (or the 1% Rule)

This rule helps investors quickly evaluate whether a rental property is likely to produce positive cash flow. It involves dividing the monthly rent by the property's purchase price and converting it into a percentage. For example, if a property rents for $2,000 a month and is valued at $200,000, dividing $2,000 by $200,000 gives us 1%, indicating it meets the 1% rule but not the 2% rule. Properties with a higher percentage are generally better for cash flow, but this varies by location and expenses. The rule serves as a preliminary filter to decide whether to investigate a property further, especially concerning cash flow potential.

The 50% Rule

The 50% rule is geared towards helping investors estimate the cash flow from a rental property by assuming that half of the income will be spent on operating expenses, excluding the loan payment. This includes costs such as taxes, insurance, utilities, and repairs. For instance, if a property generates $2,000 in monthly rent, $1,000 (50%) is expected to go towards expenses, leaving the remainder for mortgage payments and profit. This rule offers a quick way to gauge a property's financial viability but should be adjusted based on specific circumstances and expenses.

The 70% Rule

Focused on house flippers and wholesalers, the 70% rule helps determine the maximum price to pay for a property. It states that an investor should pay no more than 70% of the after-repair value (ARV) minus the cost of necessary repairs. While this rule can streamline the process of evaluating deals, its effectiveness varies based on market conditions and property values. For lower-value properties, adhering strictly to this rule might not leave enough margin for profit, whereas for high-value properties, finding deals that meet this criterion might be challenging.

Application and Limitations

Though these rules of thumb can significantly aid in the initial stages of investment analysis, they come with limitations and should not replace a comprehensive evaluation. Market conditions, property conditions, and individual financial goals can all influence the applicability of these rules. For instance, the 70% rule may not be feasible in high-cost areas, and the 50% rule might over or underestimate expenses based on the specific property and location.

Conclusion

The 2%, 50%, and 70% rules offer valuable starting points for real estate investors to quickly assess potential deals. However, they are best used as part of a broader investment strategy that includes detailed analysis and consideration of all variables involved. As with any investment, the key to success lies in due diligence, research, and adapting strategies to fit your investment criteria and goals.

For a deeper dive into these rules and how to apply them to your real estate investment strategy, watch Brenton Turner's comprehensive video here.