Create articles from any YouTube video or use our API to get YouTube transcriptions

Start for freeUnderstanding Portfolio Risk and Return Calculation

When it comes to investing, one of the most crucial skills an investor can possess is the ability to calculate and understand portfolio risk and return. These metrics are fundamental in making informed investment decisions and optimizing the performance of your investment portfolio.

Portfolio Risk Calculation Explained

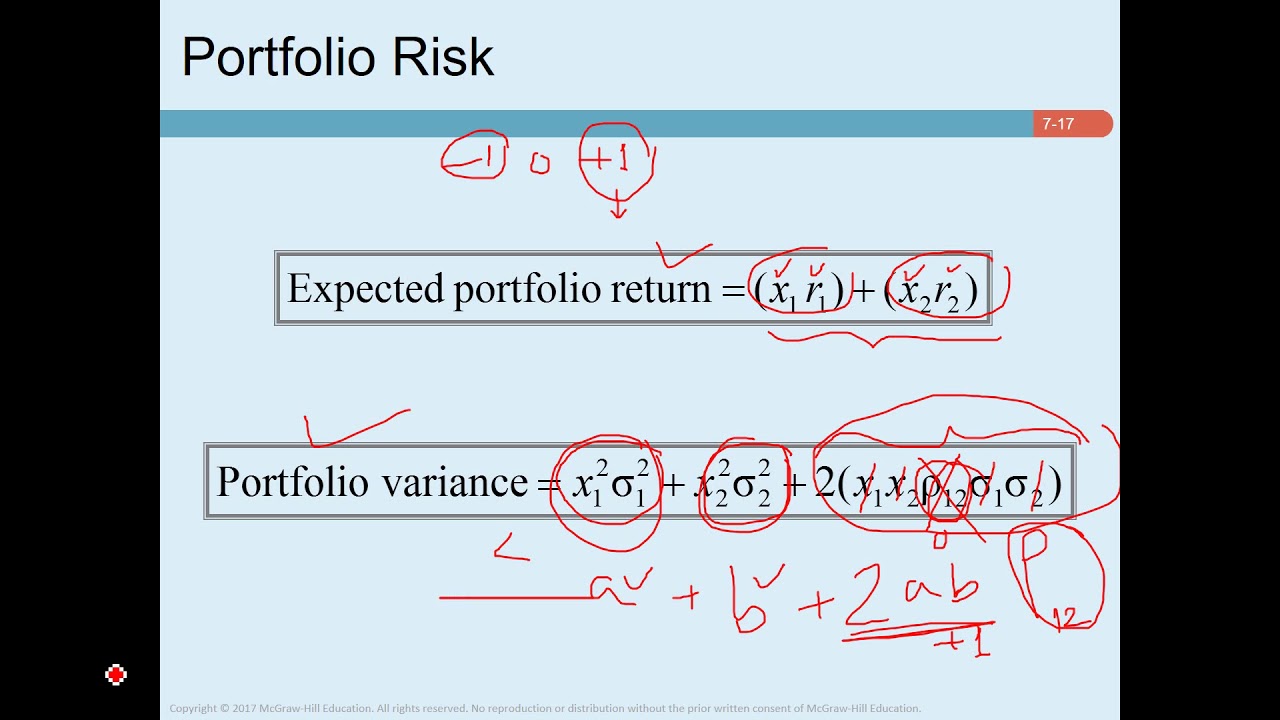

To begin with, the concept of portfolio risk is not just about the individual risks of the assets involved but also how they interact with each other within the portfolio. To calculate the risk for a two-stock portfolio, we focus on four essential components:

- The weight squared of Asset 1 multiplied by the variance of Asset 1.

- The weight squared of Asset 2 multiplied by the variance of Asset 2.

- The product of the weights of both assets with their standard deviations and the correlation between them.

The formula for portfolio variance can be summarized as follows:

Portfolio Variance = (Weight1^2 * Variance1) + (Weight2^2 * Variance2) + (2 * Weight1 * Weight2 * StdDev1 * StdDev2 * Correlation)

The Role of Correlation

Correlation is a statistical measure that expresses the extent to which two variables change in relation to each other, ranging from -1 (perfect negative correlation) to +1 (perfect positive correlation). In the context of a portfolio, if two assets have a correlation less than +1, the combined portfolio risk is typically less than the sum of the individual risks, thanks to the diversification effect.

If the correlation is zero, the diversification effect is maximized, and the portfolio variance will be less than the weighted average of the individual variances. However, if the correlation is +1, there is no diversification benefit, and the portfolio risk equals the weighted average of the individual risks.

Calculating Portfolio Return

Unlike risk, the return of a portfolio is simply the weighted average of the returns of the individual assets. The formula for a two-asset portfolio return is:

Portfolio Return = (Weight1 * Return1) + (Weight2 * Return2)

For instance, if you invest 60% in Asset 1 with an 8% return and 40% in Asset 2 with an 18.8% return, the expected portfolio return would be a weighted sum of these two, giving you a total expected return of 12.3%.

An Example of Portfolio Risk Calculation

Suppose you invest 60% of your portfolio in Stock A and 40% in Stock B, with expected returns of 8% and 18.8%, respectively. If Stock A has a standard deviation of 13.2% and Stock B has 31%, and their correlation is 1 (perfectly positively correlated), the portfolio risk would be the same as the weighted average risk of the individual stocks.

However, if the correlation were 0.019, significantly less than 1, the portfolio risk would decrease. This demonstrates the diversification benefit—combining two stocks with less than perfect correlation results in lower portfolio risk compared to the combined individual risks.

Negative Correlation and Diversification

If the correlation coefficient between two assets is negative, the diversification benefit can be even more pronounced. A negative correlation means that the assets move in opposite directions, which can further reduce portfolio risk.

To maximize the diversification benefits, the correlation between asset returns does not need to be negative; any correlation less than +1 (but still positive) can provide a diversification advantage. If the correlation is negative, the benefit is enhanced.

Key Takeaways

- Portfolio risk is not merely the weighted average of individual asset risks due to the impact of correlation.

- Portfolio return is the weighted average return of individual assets.

- Diversification benefits occur when the correlation between assets is less than +1, reducing overall portfolio risk.

- A negative correlation between assets can further reduce portfolio risk and enhance diversification benefits.

By thoroughly understanding these concepts and applying them to your investment strategy, you can better manage your portfolio's risk and optimize its return potential.

For more examples and a deeper dive into portfolio risk and return, be sure to check out the original video where these concepts are discussed in detail.