Create articles from any YouTube video or use our API to get YouTube transcriptions

Start for freeThe Dilemma of Investing a Lump Sum

When you find yourself with a significant amount of cash to invest, you're faced with a crucial decision that can impact your financial future. Should you invest it all at once in a lump sum, or should you spread it out over time using a strategy called dollar cost averaging? This question has perplexed investors for decades, and today we'll dive deep into the data and research to help you make an informed decision.

Understanding Your Options

Before we delve into the analysis, let's clearly define the three main options available when you have a lump sum to invest:

- Lump Sum Investing: This involves investing the entire amount immediately into a risk-appropriate portfolio.

- Dollar Cost Averaging (DCA): This strategy involves systematically investing equal parts of your lump sum into a risk-appropriate portfolio over a set period.

- Waiting for the Right Moment: Some investors choose to hold onto their cash until they feel it's an opportune time to invest, often trying to "buy the dip" in market prices.

The Appeal of Dollar Cost Averaging

Many investors are drawn to dollar cost averaging because it feels like a smart, measured approach. The logic often presented is that when stock prices are high, you're buying fewer shares, and when prices are low, you're buying more shares. While this is mathematically correct, it's important to understand that this doesn't necessarily lead to better outcomes.

The Behavioral Perspective

Behavioral economist Meir Statman offers a framework that explains why dollar cost averaging remains popular despite being suboptimal from a purely financial standpoint. The main appeal is psychological:

- Regret Minimization: By spreading out investments, you avoid the potential regret of investing a large sum right before a market crash.

- Emotional Comfort: Making smaller, regular investments can feel less daunting than committing a large amount all at once.

The Data: Lump Sum vs Dollar Cost Averaging

While the behavioral aspects are important to consider, it's crucial to understand the historical performance of these strategies. Let's look at some key findings from recent research:

2020 Analysis Across Six Stock Markets

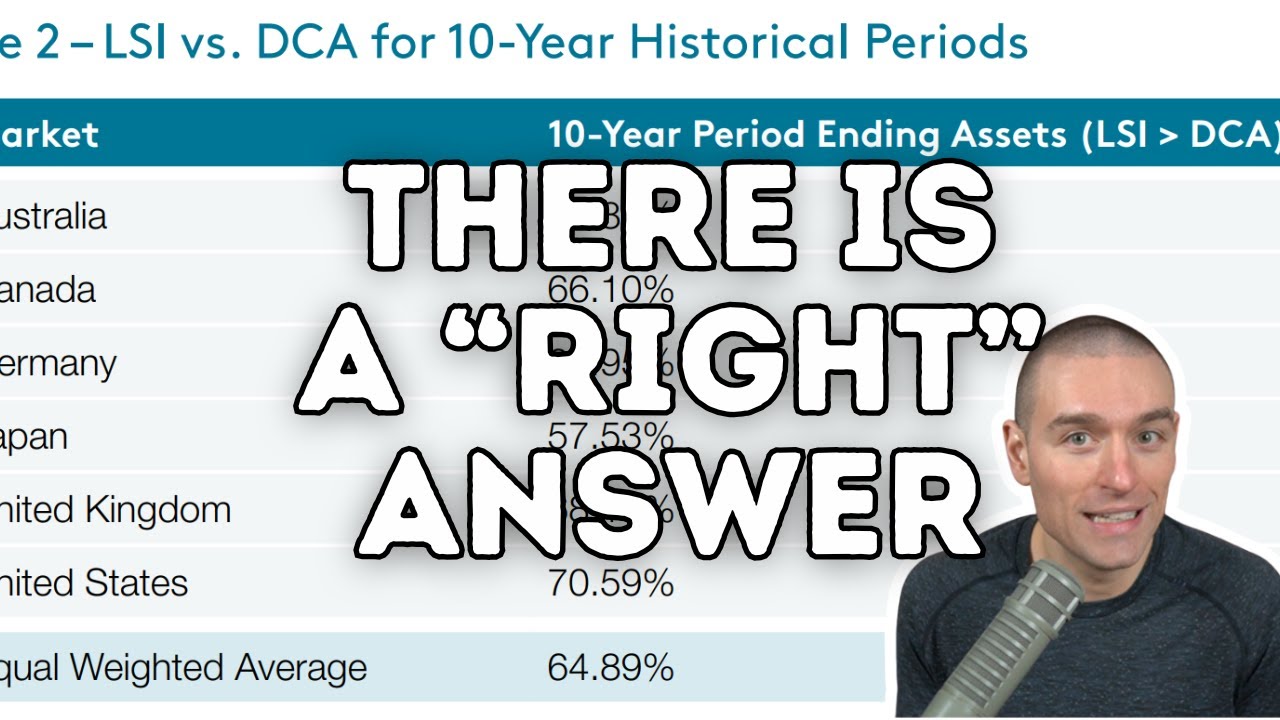

A comprehensive study in 2020 compared lump sum investing to dollar cost averaging across six different stock markets. Here are the key takeaways:

- Lump sum investing outperformed dollar cost averaging about 65% of the time.

- The approximate annualized cost of choosing dollar cost averaging was about 0.38% over 10 years.

- This cost is significantly higher than the fees charged by most index funds.

Performance in Worst-Case Scenarios

To address common concerns, the study also looked at how dollar cost averaging performed in specific challenging situations:

- In the worst 10% of outcomes for lump sum investments, dollar cost averaging did have a small advantage on average.

- However, even in these worst-case scenarios, dollar cost averaging still trailed lump sum investing more than 50% of the time.

Market Drops and High Valuations

The research also examined two specific situations that often worry investors:

- After a 20% Market Drop: Even immediately following a significant market decline, lump sum investing continued to be advantageous on average.

- High Market Valuations: When US stock valuations were in the 95th percentile of expensiveness, lump sum investing still dominated dollar cost averaging.

Historical Perspective

These findings aren't new or revolutionary. A long list of academic papers dating back to the 1970s have consistently suggested that dollar cost averaging is suboptimal in a rational decision-making framework.

Rethinking Risk Tolerance

If an investor feels the need to use dollar cost averaging for psychological comfort, it might be a sign that their chosen portfolio is too risky for their true risk tolerance. A 2016 paper in the Journal of Wealth Management provided some interesting insights:

- Dollar cost averaging is approximately equivalent to an asset allocation where only 50-65% of the portfolio is invested in risky assets, with the rest in risk-free assets.

- However, this approach is suboptimal compared to a portfolio with a constant 50-65% allocation to risky assets.

- The authors concluded that risk-averse investors might be better off investing a lump sum in a more conservative asset allocation rather than dollar cost averaging into a more aggressive one.

The Pitfalls of Waiting to "Buy the Dip"

Many investors are tempted to wait for a market decline before investing their lump sum, hoping to "buy the dip." However, research shows this strategy is often counterproductive:

- Waiting for a 10% or 20% market decline to invest a lump sum underperforms on average and in most ten-year periods.

- Waiting for a 20% drop gives up more return and underperformed more frequently than waiting for a 10% drop.

- This holds true even when the analysis starts from all-time market highs.

Making the Decision: Factors to Consider

When deciding between lump sum investing and dollar cost averaging, consider the following factors:

- Risk Tolerance: Honestly assess your ability to withstand short-term market fluctuations.

- Investment Time Horizon: The longer your investment horizon, the more you might benefit from lump sum investing.

- Market Conditions: While timing the market is generally inadvisable, extreme market conditions might influence your decision.

- Psychological Comfort: If the thought of investing a large sum all at once causes significant stress, a middle-ground approach might be appropriate.

Practical Strategies for Implementation

If you decide to invest a lump sum:

- Ensure Proper Asset Allocation: Make sure your portfolio is aligned with your risk tolerance and investment goals.

- Diversify Broadly: Spread your investments across various asset classes and geographic regions.

- Consider Tax Implications: Consult with a tax professional to understand any tax consequences of your investment.

If you opt for dollar cost averaging:

- Set a Fixed Schedule: Decide on a specific timeframe and stick to it, regardless of market movements.

- Automate the Process: Use automatic investments to remove emotion from the equation.

- Keep Costs Low: Use low-cost index funds or ETFs to minimize the impact of transaction fees.

The Bottom Line

Based on historical data and numerous studies, investing a lump sum in a risk-appropriate portfolio as soon as possible is likely to be the optimal strategy for most investors. However, personal circumstances, risk tolerance, and psychological factors play a crucial role in this decision.

If the idea of investing a large sum all at once causes significant anxiety, it might be worth considering a more conservative asset allocation rather than resorting to dollar cost averaging with a riskier portfolio.

Remember, the most important factors in long-term investment success are:

- Choosing an appropriate asset allocation

- Minimizing costs

- Maintaining discipline through market ups and downs

- Regularly rebalancing your portfolio

Whether you choose to invest a lump sum or dollar cost average, staying focused on these principles will serve you well in the long run.

Final Thoughts

Investing can be emotionally challenging, especially when dealing with large sums of money. While the data strongly supports lump sum investing in most cases, the most important thing is to choose a strategy that allows you to sleep well at night and stick to your long-term investment plan.

Remember that no one can predict short-term market movements with consistency. The key to successful investing is to focus on what you can control: your asset allocation, your costs, and your behavior.

By understanding the pros and cons of different investment strategies and aligning your approach with your personal risk tolerance and financial goals, you'll be well-positioned for long-term investment success.

Additional Resources

If you're interested in diving deeper into this topic, here are some recommended resources:

- "A Random Walk Down Wall Street" by Burton Malkiel

- "The Intelligent Investor" by Benjamin Graham

- "The Four Pillars of Investing" by William Bernstein

- The Bogleheads' Guide to Investing by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf

These books provide a solid foundation in investment principles and can help you make more informed decisions about your financial future.

Remember, while it's important to educate yourself about investment strategies, it's equally important to recognize when you might benefit from professional advice. If you're unsure about how to proceed with a large investment, consider consulting with a fee-only financial advisor who can provide personalized guidance based on your specific situation and goals.

Investing is a journey, not a destination. By staying informed, maintaining discipline, and focusing on your long-term objectives, you'll be well-equipped to navigate the ups and downs of the financial markets and work towards achieving your investment goals.

Article created from: https://youtu.be/KwR3nxojS0g?si=Ge4iiDxjAS7Fxr3b