Create articles from any YouTube video or use our API to get YouTube transcriptions

Start for freeThe 2025 US Tariff Announcement: A Seismic Shift in Global Trade

On April 2, 2025, the United States government unveiled a sweeping new tariff policy that sent shockwaves through global markets. This move, dubbed "liberation day" by President Donald Trump, marked a dramatic escalation in ongoing trade tensions between the US and its major trading partners. The announcement triggered immediate market turmoil, with the S&P 500 plummeting over 10% in just two days.

This article will examine the details of this policy shift, its potential economic impacts, and what it means for investors and global trade moving forward.

Key Points of the New US Tariff Policy

Universal 10% Tariff

The cornerstone of the new policy is a flat 10% tariff on all imports into the United States, with few exceptions. This universal tariff is set to take effect on April 5, 2025.

Targeted Higher Tariffs

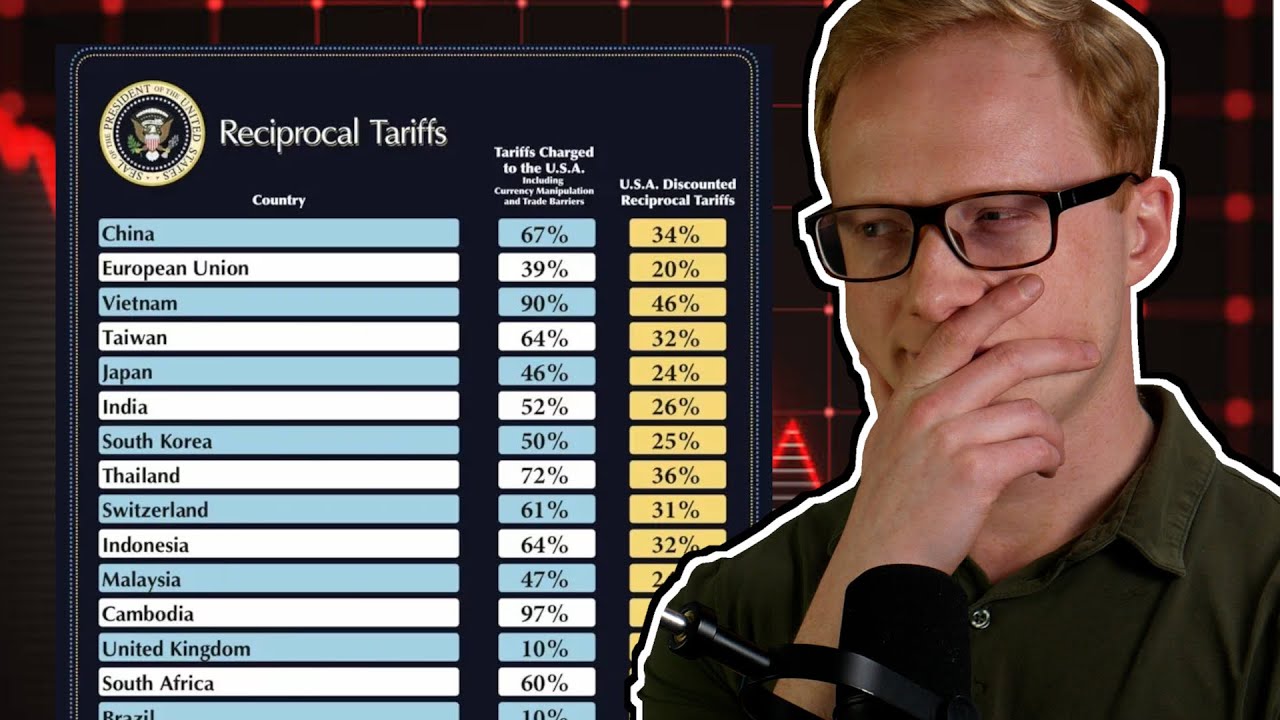

Beyond the universal tariff, the US government identified several countries it deemed "worst offenders" in terms of trade practices. These nations face even steeper tariffs:

- European Union: 20% tariff

- China: 34% tariff (in addition to previously announced tariffs, bringing the total to over 50%)

- Some countries face tariffs as high as 50%

These targeted higher tariffs are scheduled to begin on April 9, 2025.

Limited Exemptions

Despite earlier statements that no exemptions would be granted, the policy does include some carve-outs:

- Canada and Mexico are exempt from the new tariffs

- Certain products and commodities are excluded, including:

- Copper

- Pharmaceuticals

- Semiconductors

- Lumber

- Gold

- Energy

- Select materials

The Economic Impact of the New Tariffs

Projected Effects on the US Economy

According to analysis from the Budget Lab at Yale University, the new tariff regime is expected to have significant economic consequences:

- The average effective US tariff rate will jump to 22.5%, up from just 2% in 2024

- This represents the highest tariff rate since 1909

- Short-term inflation is projected to rise by 2.3%

- The average US household could face increased costs of $3,800

- Real GDP growth is forecast to be nearly a full percentage point lower by 2025

- Long-term projections suggest the US economy could be persistently 0.5% smaller

- Annual economic costs are estimated between $100-180 billion

Global Supply Chain Disruption

The severity of these new tariffs has raised concerns about pushing the US and its trading partners into a recession. This is particularly worrying given how globally integrated supply chains have become over recent decades.

Many economists draw parallels to the Smoot-Hawley Tariffs of 1930, which are widely blamed for exacerbating the Great Depression.

Stock Market Vulnerability

While the projected GDP impact may seem modest compared to the stock market's reaction, it's important to note that publicly traded companies are often more exposed to trade disruptions than the broader economy:

- Foreign sales represent 41% of S&P 500 company revenues

- Many industries rely heavily on global supply chains for raw materials and components

- Certain sectors, like apparel, are disproportionately affected (clothing prices are projected to rise 17%)

Currency Implications

Reduced global trade could weaken the US dollar's position as the world's dominant reserve currency. Early signs of dollar weakening were observed following the announcement.

Controversial Calculation Method

One of the most contentious aspects of the new tariff policy is the method used to determine the rates for specific countries. Despite being presented as "reciprocal" tariffs, the actual calculation has little to do with other nations' tariff policies.

The Formula Revealed

The White House released details of their tariff calculation formula, which can be simplified to:

Tariff Rate = (Country's Net Exports to US) / (Country's Imports from US)

This formula is based entirely on trade balances rather than actual tariff rates, currency manipulation, or other trade barriers.

Criticism of the Approach

Economists and trade experts have widely criticized this methodology:

- It assumes all trade deficits result from unfair practices

- It ignores legitimate factors that can create trade imbalances (e.g., differences in labor costs, natural resources, or consumer demand)

- Some countries with minimal trade barriers face high tariffs due to their trade surplus with the US

- The formula produced absurd results for some territories, like uninhabited islands

Global Reactions and Potential Retaliation

The aggressive nature of the US tariff policy has prompted strong reactions from governments worldwide:

- Many world leaders have declared intentions to retaliate with their own tariffs

- China, South Korea, and Japan are exploring strengthened trade ties and coordinated responses

- The US Treasury Secretary has urged countries not to retaliate, but this plea seems likely to fall on deaf ears

Implications for Investors

For those invested in the US stock market or global equities, the new tariff regime presents significant challenges:

Increased Recession Risk

The policy substantially raises the likelihood of a US or global recession, especially if widespread retaliation occurs.

Sector-Specific Impacts

Certain industries will be hit harder than others. Investors should carefully evaluate their portfolio's exposure to sectors like:

- Textiles and apparel

- Consumer electronics

- Automotive

- Agriculture

Long-Term vs. Short-Term Thinking

While the immediate market reaction has been severe, it's crucial for investors to maintain perspective:

- Timing the market around political developments is notoriously difficult

- The situation remains fluid, with the possibility of policy reversals or new trade agreements

- Historically, markets have recovered from periods of trade tension and uncertainty

Diversification Remains Key

A well-diversified portfolio can help mitigate some of the risks associated with trade disruptions and market volatility.

The Road Ahead: Uncertainty and Adaptation

As the global economy grapples with this new trade landscape, several key themes are likely to emerge:

Supply Chain Reorganization

Companies will need to reevaluate and potentially restructure their global supply chains to minimize tariff impacts.

Domestic Industry Shifts

Some US industries may benefit from reduced foreign competition, but often at the cost of higher prices for consumers and reduced choice.

Diplomatic Tensions

Trade relations between the US and its partners will face significant strain, potentially spilling over into other areas of international cooperation.

Innovation Pressures

Firms may accelerate efforts to innovate and automate to offset higher input costs and maintain competitiveness.

Conclusion: Navigating a New Trade Era

The 2025 US tariff escalation represents a pivotal moment in global economic history. Its full ramifications will likely take years to fully manifest and understand. For investors, policymakers, and business leaders, staying informed and adaptable will be crucial in the face of this new trade paradigm.

While the immediate outlook may seem daunting, it's important to remember that economies and markets have weathered trade disputes before. The coming months and years will undoubtedly bring challenges, but also opportunities for those prepared to navigate this shifting landscape.

As events continue to unfold, maintaining a long-term perspective and seeking expert guidance can help stakeholders make informed decisions in these uncertain times. The global economy is entering uncharted waters, but with careful analysis and strategic planning, it's possible to chart a course through the turbulence ahead.

Article created from: https://youtu.be/ZbreGo0j4ko?si=8pyZVoVug0mEz-Ar